We are asset managers first and foremost; then, we are financial advisors. Focusing on the financial markets first provides us with the tools and knowledge to be better financial advisors, which aligns our objectives with yours: superior allocation decisions.

Use our experience, knowledge, research, and passion for the financial market to grow and protect your wealth.

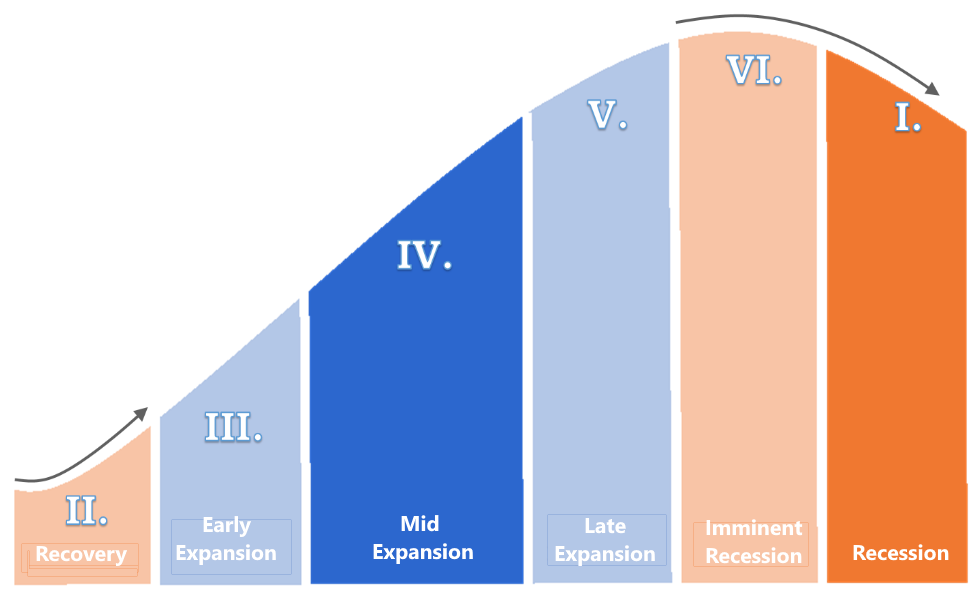

We are here to help navigate the business cycle, providing you the ability to adapt to changes in the financial markets. It does not matter if you are a professional, a DIY investor, or a client of ours, we want to share our knowledge and experience to help you meet your investment objectives. Whether or not you want us to directly manage your investment portfolio, we have useful tools available to you.

Industry professionals and financial advisors can partner with us and set up strategies that meet their clients’ goals.

DIY investors can subscribe and use our framework to help with their allocation decision-making.

investors looking for a more hands-off approach can open an account with us and allow us to manage their assets directly.

Receive our economic updates, tips, articles, tools for investors, and more information about our solutions and events conveniently delivered to your inbox.

The absolute and relative performance of broad asset classes is systematically related to macroeconomic trends, both cyclical and secular. These trends are inflation, interest rates, actual gross domestic product (GDP), profits, and income growth. The business cycle includes a monetary policy cycle, a profit cycle, credit cycles, inventory cycles, and cycles in housing and durable goods demand. Each business cycle has a pattern that rhymes while not precisely repeating. In other words, “every cycle is the same except for what’s different.” Plenty of studies suggest these macroeconomic factors explain the variance in asset prices. Take, for example, Black Rock; they identified six macroeconomic factors that can explain 90% of the market variance.

The Fearless Girl is a bronze sculpture by Kristen Visbal, commissioned by State Street Global Advisors, a large asset management company. It currently resides in front of the New York Stock Exchange building in Manhattan's financial district in New York City.

Fearless Girl was commissioned to advertise for an index fund that comprises gender-diverse companies with a relatively high percentage of women among their senior leadership.

To us, the Fearless Girl represents the present and past inequality in the Wall Street elite. Not so long ago, Wall Street was one big men's club of smoke-filled rooms with very few females on the trading floor. To the degree that they were welcome, their role was isolated to secretaries and administrative duties. While the atmosphere has changed, there is still more work to do. Here at Omega was strive to create a culture of diversity towards both race and gender. We spotlight the Fearless Girl as a reminder that we must do more. We support and value the women in Wall Street and encourage other financial firms to do the same.